Table Of Content

What to Look for When Choosing an ETF

When choosing an ETF, investors should look beyond just past performance. Consider how it fits your investment goals, costs, and risks. Here are key factors to guide your evaluation:

Expense ratio – Lower fees can mean better long-term returns

Underlying index or assets – Know what the ETF is actually tracking

Liquidity and trading volume – Higher volume means tighter bid-ask spreads

Tracking error – Measures how well the ETF follows its index

Tax efficiency – Some ETFs are better structured for minimizing taxes

Issuer reputation – A well-known provider may offer more transparency

Holdings and sector exposure – Know if you're overly concentrated

Fit within your portfolio – Ensure it complements your overall strategy

-

Evaluate the ETF’s Expense Ratio

The expense ratio is one of the most important metrics to compare. It shows how much you'll pay annually as a percentage of your investment.

For example, Vanguard S&P 500 ETF (VOO) has an expense ratio of 0.03%, while SPDR S&P 500 ETF (SPY) charges 0.09%. While this seems small, on a $100,000 investment, the difference adds up over time.

A lower fee doesn’t always mean better returns, but it reduces drag on your performance—especially in passive strategies

ETF Name | Expense Ratio | 5-Year Return | Assets Under Management |

|---|---|---|---|

VTI (Vanguard Total Stock Market) | 0.03% | 11.1% | $350B |

SCHB (Schwab U.S. Broad Market) | 0.03% | 10.9% | $30B |

ITOT (iShares Core S&P Total U.S.) | 0.03% | 11.0% | $50B |

-

Understand What the ETF Tracks

Not all ETFs are created equal—even those with similar names. One S&P 500 ETF may track the full index, while another might use a sampling strategy or apply weighting adjustments.

Consider Invesco S&P 500 Equal Weight ETF (RSP) versus SPY. RSP gives equal weight to each company, whereas SPY is cap-weighted, giving larger companies more influence.

This leads to very different performance and risk characteristics. Always check the fund’s prospectus or factsheet to understand the methodology

-

Look at Liquidity and Volume

An ETF’s liquidity affects how easily and cheaply you can trade it.

High daily trading volume usually means lower spreads between the bid and ask prices. For example, iShares MSCI Emerging Markets ETF (EEM) trades millions of shares daily, offering tight spreads.

On the other hand, niche or thematic ETFs—like a space exploration fund—may have low volume, making them more expensive to trade or harder to exit quickly. Liquidity is crucial for active traders or large investors.

ETF | Avg Daily Volume | Bid-Ask Spread | Assets Under Management | Liquidity Rating |

|---|---|---|---|---|

SPY | 80M+ | Very tight (<0.01%) | $500B+ | Excellent |

IWM (Russell 2000) | 20M+ | Tight (<0.05%) | $70B+ | Strong |

VBR (Vanguard Small-Cap Value) | 300K | Moderate | $50B | Moderate |

ARKG (ARK Genomic Revolution) | 200K | Wider spreads | $2B | Low |

-

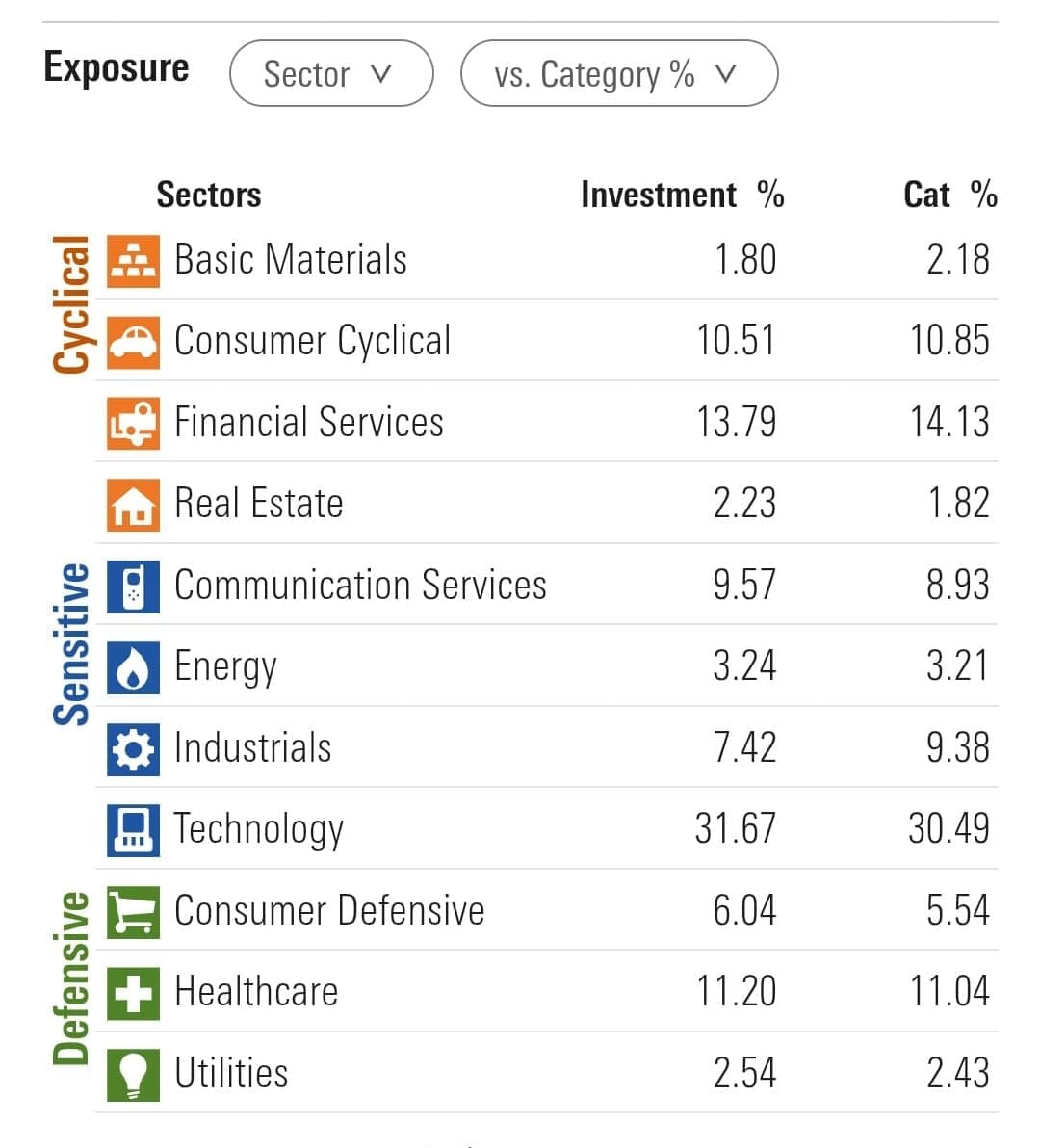

Check the Holdings and Sector Exposure

Two ETFs with similar names can have very different holdings.

Tech ETFs, for instance, might be heavily weighted toward a few mega-cap stocks like Apple and Microsoft. If you already own these in your portfolio, adding such an ETF might lead to concentration risk.

On the flip side, sector ETFs like Utilities Select Sector SPDR Fund (XLU) may help diversify a growth-heavy portfolio. Always scan the top holdings and sector allocation before buying.

-

Examine Tracking Error

Tracking error tells you how closely the ETF mirrors the returns of its benchmark.

If a fund consistently underperforms its index due to poor tracking, it may not be a good choice, especially for passive investors.

For instance, if an ETF tracking the Nasdaq-100 consistently returns less than the actual index, you're not getting the exposure you expected.

Some ETFs may use derivatives or sampling, which can increase tracking error—check the ETF’s historical performance versus the index

ETF | Index Tracked | Tracking Error | Expense Ratio |

|---|---|---|---|

SPY | S&P 500 | 0.04% | 0.09% |

IVV | S&P 500 | 0.02% | 0.03% |

VOO | S&P 500 | 0.01% | 0.03% |

-

Assess the ETF’s Role in Your Portfolio

Consider how the ETF fits within your overall investment plan. Are you looking for broad diversification, sector-specific exposure, or international assets?

For example, a retiree might prefer dividend ETFs like Vanguard Dividend Appreciation ETF (VIG) for income, while a younger investor may choose a growth ETF for long-term capital gains.

The ETF should align with your risk tolerance, time horizon, and financial goals—not just recent performance or popularity.

How to Use ETF Screeners to Find And Compare the Best Funds

ETF screeners are essential tools for narrowing down the vast universe of ETFs based on your criteria.

Platforms like Morningstar, ETF.com, and Fidelity allow you to filter funds by asset class, sector, region, expense ratio, performance, and more.

Platform | Strengths | Best For |

|---|---|---|

Morningstar | Fund ratings, in-depth data | Long-term investors |

ETF.com | Easy-to-use filters, fund comparisons | Beginners & intermediates |

Fidelity | Custom filters, research tools | Active DIY investors |

Seeking Alpha | Quant rankings, user analysis | Fundamental-focused investors |

For example, if you want low-cost ETFs with at least a 4-star Morningstar rating, you can set those filters to generate a refined list.

Here are some common comparison parameters to look for when searching ETFs:

Filter by expense ratio to find low-cost ETFs for long-term investing

Use performance metrics like 3- and 5-year returns to identify consistent performers

Narrow results by fund type (e.g., sector, dividend, bond, international)

Apply risk and volatility filters to match your tolerance level

Check liquidity indicators like trading volume and bid-ask spread

How to Align an ETF With Your Investment Strategy

Matching the ETF’s objective with your personal plan ensures you're not just chasing returns but building a consistent, goal-aligned portfolio.

The right ETF should match your risk tolerance, investment goals, and time horizon.

Growth-oriented investors might prefer tech or innovation-focused ETFs for capital appreciation

Income-seekers could look at dividend ETFs like SCHD or VIG

Conservative investors might favor bond ETFs or defensive sectors

Those seeking diversification may lean toward total market or international ETFs

For example, a young investor with a long time horizon may invest in ARK Innovation ETF (ARKK) to target disruptive technology, accepting more volatility in exchange for growth.

In contrast, someone nearing retirement may prefer iShares Core U.S. Aggregate Bond ETF (AGG) for stable income.

FAQ

There’s no single best factor—it depends on your investment goals. However, most investors prioritize low expense ratios, strong tracking performance, and fund fit within their portfolio.

Check the number of holdings and sector allocation in the ETF’s factsheet or on sites like Morningstar. A broadly diversified ETF typically offers exposure to multiple sectors and companies.

The index shows what the ETF aims to replicate, which directly affects performance, risk, and sector exposure. Always review the index methodology to ensure it aligns with your expectations.

A tight bid-ask spread means you’ll pay less to buy and sell the ETF. It reflects high trading volume and liquidity, which can significantly affect short-term trading costs.

Turnover refers to how often the ETF’s holdings are bought and sold. High turnover can lead to more taxable events and may indicate a more actively managed strategy.

Look at the provider’s history, size, and lineup of existing funds. Firms like Vanguard, BlackRock (iShares), and Schwab are known for stability and investor-friendly practices.

Yes, a longer track record can provide more data on how the ETF performs in different market conditions. New ETFs may carry more uncertainty or lack liquidity.

Match the ETF’s volatility and asset class with your timeline. For example, equities may suit long-term investors, while bond ETFs may be better for those nearing retirement.

A high tracking error means the ETF may not accurately mirror its index, potentially reducing expected returns. Look for funds with a history of low tracking error if index precision is important to you.

These ETFs track custom indexes built around factors like value, momentum, or quality. They offer more strategic exposure than traditional market-cap-weighted ETFs.